Table of Contents

You’ve probably thought about investing in real estate but stopped yourself with questions like “Where do I even start?” or “Do I need a ton of money to get in?” That is quite a common hesitation among beginners.

Most beginners think real estate is only for people with deep pockets or insider connections. The truth is, you don’t need either, but you do need the right strategy to get started.

With the right strategy, investing in real estate can be profitable and, over time, provide a steady source of passive income.

And thankfully, there are a plethora of options that do not require managing a property or being a landlord as a beginner. This guide will walk you through the process of investing in real estate as a beginner.

You’ll also learn why real estate matters, the risks to look out for, and seven simple strategies you can use to start today—even if you’re on a tight budget.

What is Real Estate?

Real estate isn’t just houses, apartments, or office buildings. It is a land property and everything permanently attached to it, that is, homes, rental units, warehouses, schools, shopping malls, and even farmland.

Unlike stock investments or crypto, real estate is tangible. You can see it, walk through it, and in many cases, live in it. That’s why it feels safer for many new investors.

Real estate is a long-term wealth-building system that will always hold value as long as people need places to live, work, and store things.

Even if the markets rise and fall, the demand for property will never diminish. That’s why it’s been one of the most reliable investment schemes for centuries.

For beginners, investing in real estate gives you full control compared to stocks, where you bet on companies you can’t run and can’t decide the returns you get from your investment.

With real estate, you make the decisions—who rents, how much rent to charge, and how you maintain the property. That level of control is rare in stock investing.

10 Reasons to Invest in Real Estate

If you’re still unsure about investing in real estate, here are ten solid reasons investors, myself included, keep coming back to it:

1. Passive income

One of the primary benefits of real estate, and why it’s an appealing investment to many, is that it provides steady income to investors. Investors can rent or lease their properties to earn consistent passive income.

2. Inflation hedge

Real estate often correlates with inflation. As the cost of living, building materials, and labor increases, so does the value of property and the cost of construction.

This can prompt landlords and other real estate investors to raise the rent on their properties, thereby maximizing their income. This means, with real estate, the value of your money tends to increase rather than decrease with inflation.

What’s more, when inflation rises, the money you owe on a fixed-rate mortgage doesn’t change. Your loan balance stays the same in nominal terms, but the value of the dollars you’re repaying it with reduces, which makes the debt a lot easier to pay off.

3. Control over your investment

Real estate is one investment where you have full control over your investments and assets.

With stocks, how much ROI you get depends on multiple factors that are out of your control, but with real estate, only you make the decision on how much you make, where you invest, how you manage your property, and the tenants you accept.

With this full control, you can influence the results of your investment and implement strategies to maximize your income.

4. Appreciation

Over time, most properties naturally increase in value. On average, property values rise about 5.2% year over year.

So if you’re looking to grow your wealth over time with real estate, you can steadily grow your net worth and create extra equity you can use later to buy more properties.

Unlike stocks or gold, investing in real estate allows you to leverage that appreciation into real assets that keep working for you.

5. Leverage

Few investments let you use other people’s (the bank’s) money to build your own wealth the way real estate does. With a mortgage, you can put a down payment of 20–25%, and the bank covers the rest.

If you’ve been wondering whether you need a ton of money to invest in real estate, I guess this answers your question. You don’t need a full down payment to enjoy the rental income, appreciation, and full tax benefits real estate offers. No other asset class gives you this level of buying power and control.

6. Tax benefits

Real estate lets you keep more of your rental income because you’re taxed only after expenses. Repairs, insurance, depreciation, and even mortgage interest can all be written off. If you’re financing with a loan, the interest deduction often lowers your tax bill even more.

7. Diversification

Real estate has a low correlation with stocks, gold, or the crypto market, making it a secure and reliable investment that helps you reduce overall risks and diversify your investment portfolio. And as you receive consistent income from your real estate investments, you can also offset the losses from your other assets. For example, let’s say you invested in stocks, and the market is down 15% in a year, but your rental property still brings in steady monthly rent.

That reliable cash flow helps offset the losses, helping you balance out your overall returns so your portfolio doesn’t rely on just one type of asset that brings inconsistent income. So, with the diversification benefits that real estate provides, you can protect your money against swings in the market or your other businesses.

8. Equity building

Every time you make a mortgage payment, part of it goes toward reducing the loan balance. Over time, you own more of the property while the value of that property naturally appreciates. It’s a double win: your debt reduces while your asset grows.

For example, if you buy a home for $200,000 and pay down $20,000 of the loan while the property appreciates to $230,000, your equity has grown by $50,000 without you selling anything. This equity becomes a financial safety net you can fall back on or use later through refinancing, selling, or using it to fund more investments.

9. Demand

One of the top reasons to invest in real estate is consistent demand. Housing is a basic human need, and as long as people need places to live, run a business, and work, the demand for real estate will always persist. For you, this means there will be a constant need for your property, thereby providing you with a steady source of income or revenue.

10. Legacy

Legacy building is another undeniable reason why investing in real estate as a beginner makes sense. Unlike your savings in the bank that lose value to inflation, real estate often appreciates and can be passed down to your children or grandchildren.

That inheritance can provide a steady income or become a valuable asset they can sell or refinance, making real estate one of the most practical ways to grow and protect family wealth.

The Risks of Investing in Real Estate

It’s easy to get carried away with the success stories you hear about real estate, or get psyched up with the ten reasons to invest in real estate I just mentioned above. But just like any investment, there are risks you need to weigh before venturing into it. Here are the common challenges you are likely to encounter when investing in real estate:

1. Illiquidity

Unlike stocks, you can’t just click “sell” and cash out. Real estate takes time, effort, and patience to sell. Finding the right buyer can take longer, and if you need to sell quickly, you may have to lower your price, sometimes below what you hoped, just to close the deal.

For beginners, this process is often slower. You’ll need to market the property, handle inspections, and review paperwork, all while hoping the buyer doesn’t back out at the last minute.

And even if you work with real estate agents to speed up the process, commissions can reduce your profit even more if you’re pressured to do a distress sale.

That’s why real estate is considered illiquid, you can’t always convert it into cash when you need it most.

2. Economic downturns

When the economy slows, people lose jobs or cut back on spending. That affects both residential and commercial real estate. If you own a housing property, more tenants may struggle to pay rent, vacancies may increase, and you might have to lower rent to keep units occupied.

On the commercial side, businesses may downsize, close, or delay new leases, leaving office or retail spaces empty.

Property values also tend to dip during downturns. If you need to sell, you may get far less than your purchase price, especially if buyers are scarce or financing is harder to secure due to tighter lending.

That’s exactly what many investors experienced during the 2008 housing crash: values dropped sharply, and those who were overleveraged struggled the most.

But the flipside is that economic downturns can also create buying opportunities for investors with cash reserves. If you can hold your properties and ride it out, you may be able to pick up new investments at discounted prices.

3. Tenant problems

While tenants are the source of your rental income, they can also create challenges that eat into profits and peace of mind. Some tenants may damage your property, leading to costly repairs. Some may have trouble paying rent on time, disrupting your cash flow.

If you try to get them to evacuate your property, you may also need to clean, repaint, or renovate before renting it out again, and if you can’t get a new tenant quickly, you may lose rental income while covering mortgage, taxes, and maintenance.

4. Maintenance costs

Properties need constant care, and the costs don’t stop even if the property isn’t bringing in income. You’ll deal with regular expenses like plumbing fixes, painting, roofing, landscaping, or replacing appliances.

Sometimes, unexpected, big-ticket repairs, such as a broken HVAC system or foundation issues, may occur, and these can wipe out months of rental income. If you ignore maintenance, the value of your property drops, and tenants may leave, or worse, you might struggle to attract tenants.

5. Location risks

If you buy or build a property in the wrong area, let’s say, a neighborhood with declining demand, high crime rates, poor infrastructure, or limited job opportunities, you may struggle to attract tenants or buyers, which can lower rental income, increase vacancy rates, and slow down property appreciation.

Even if the location seems good today, things can change. A new highway rerouting traffic, a factory shutting down, or businesses moving out of the area can all affect property values.

So while “location, location, location” is often pitched as the golden rule in real estate, it cuts both ways. A great spot can boost returns, but a bad or declining one can trap your money and limit growth.

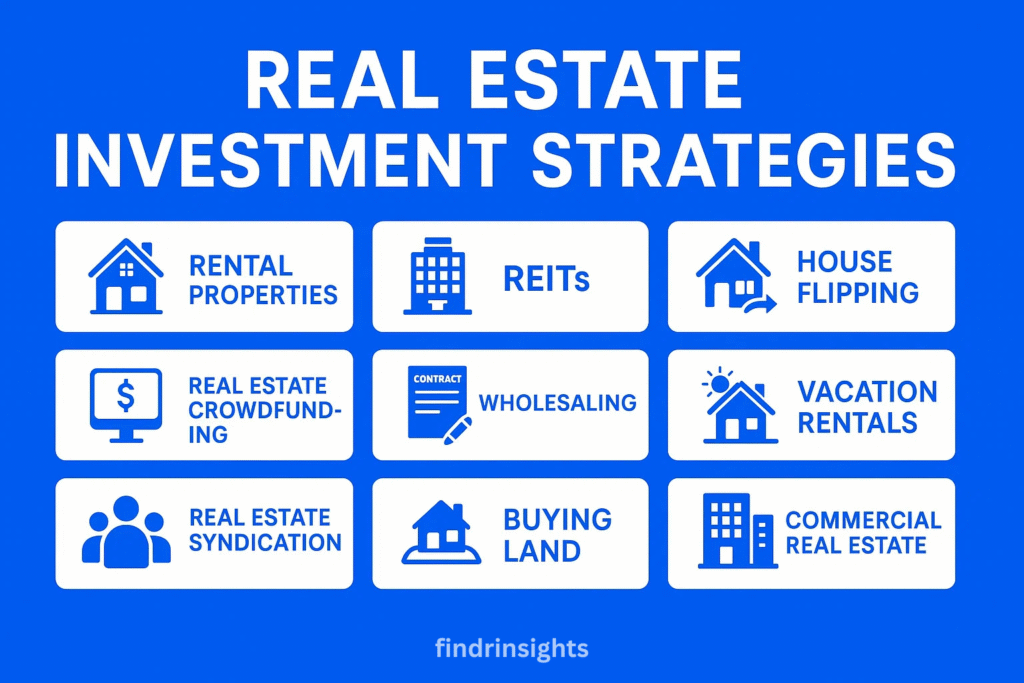

How to Invest in Real Estate: 7 Simple Strategies for Beginners

Now let’s get practical. Here’s how you can start investing in real estate, step by step. These are simple strategies that actually work for beginners with little capital.

1. House Hacking

One of the smartest beginner moves for investing in real estate is house hacking. This strategy involves you buying a property, living in one part of it, and renting out the other units or rooms to cover your mortgage and expenses.

For example, you could buy a duplex, live in one unit, and rent out the other. Or, you could rent out spare bedrooms in a single-family home.

The rent your tenants pay reduces or even eliminates your housing costs, which means you’re essentially living for free while building equity in the property. Over time, as rents increase and your mortgage goes down, you create cash flow that grows your wealth.

House hacking is considered one of the simplest ways to break into real estate investing because you get the benefits of being both a homeowner and an investor at the same time.

2. Rental Properties

Rental properties are one of the core real estate investing strategies—and probably the one most people think of first.

Unlike house hacking, this strategy involves buying a property, leasing it to tenants, and collecting rent every month without living in it yourself.

That rent not only covers your mortgage, taxes, insurance, and maintenance, but it can also leave you with positive cash flow. Over time, the property appreciates, and so does your monthly income and long-term equity growth.

This strategy is straightforward, but it requires good tenant management and the ability to cover costs when units sit vacant.

3. Real Estate Investment Trusts (REITs)

If you’re not ready or don’t have the money to buy a physical property, REITs allow you to invest in real estate without directly owning a physical property. It is one of the easiest approaches for beginners and a good way to test the waters.

Instead of buying physical property, you invest in companies that own or finance income-producing real estate, like apartments, office buildings, shopping centers, or warehouses. Think of it like buying stock in real estate.

You can buy shares of a REIT through the stock market, which makes it more liquid than owning a physical property. Many REITs also pay dividends, so you still get regular income without having to deal with tenants, repairs, or property management.

For beginners who want exposure to real estate but don’t have the capital, time, or interest in managing property, REITs are a low-barrier entry point.

4. Real Estate Crowdfunding Platforms

A similar strategy to REITs is investing in real estate through real estate crowdfunding platforms, where you pool money with other investors through an online platform. The platform then uses that capital to fund real estate projects, like apartment complexes, commercial buildings, or development deals.

This gives you a chance to invest in real estate with far less money than it would take to buy property outright. Some platforms let you start with as little as a few hundred dollars, and then you earn returns either through rental income distributions, interest payments, or property appreciation when the project sells.

This strategy makes real estate easy to diversify without the heavy responsibility of managing property. However, your money can be locked in for years, depending on the deal, and returns depend on how well the project performs.

5. Flipping

This strategy is highly profitable but not as beginner-friendly as house hacking, rentals, or REITs.

You buy a property below market value (often because it needs repairs), renovate it, and then sell it quickly at a higher price. The profit comes from the difference between what you bought it for, the cost of renovations, and the final sale price.

Flipping houses can provide great returns in a short period, but it comes with higher risks. Renovations often cost more and take longer than expected, and the changes in market conditions can leave you stuck with a property you can’t sell for the profit you hoped. Plus, you need solid knowledge of construction costs, good contractors, and strong cash reserves.

6. Wholesaling

With wholesaling, you don’t actually buy the property. Instead, you find a property that’s undervalued, get it under contract with the seller, and then assign that contract to another buyer (usually an investor) for a fee. It’s like being the middleperson who connects motivated sellers with cash-ready buyers.

The benefit is that it requires little to no capital because you’re not purchasing the property yourself. You also avoid the risks of ownership, like repairs or vacancies.

But you’ll need strong negotiation skills, an eye for deals, and a solid buyer network. If you can’t find a buyer in time, the deal may fall apart.

For beginners, wholesaling can be a way to learn the business, build connections, and generate quick cash—but it’s more of a short-term income play than a long-term wealth-building strategy.

7. Short-Term Lets (Airbnb, Vacation Rentals)

Short-term lets have become very popular in recent years and are a great opportunity to generate steady cash flow. Instead of renting to long-term tenants, you lease your property for days or weeks at a time.

This often brings in higher rental income compared to traditional leases, especially if your property is in a prime location that is near business hubs, tourist attractions, or airports.

Short-term lets provide flexibility and potentially higher returns, and the best part is that you can adjust pricing based on demand, block off dates for personal use, and tap into a global pool of guests.

However, it requires hands-on management (or a property manager), frequent cleaning, and dealing with higher turnover. Regulations in some cities can also limit or ban short-term rentals, which can be a risk to your investment.

For beginners, short-term lets can be a great way to get into real estate investing if you already own a property in a desirable location. But being successful depends heavily on local laws, demand, and your ability to manage the guest experience.

8. REIGs

Another real estate investing strategy is REIGs, and they sit somewhere between owning rental properties and investing in real estate investment trusts (REITs).

With REIGs, you’re pooling money with a smaller group of investors to directly own part of a physical property or properties.

It’s more of a property ownership strategy where you’re closer to the benefits of being a landlord (cash flow + appreciation) but without the headaches of actually managing the property yourself.

So the way to see it is:

- REITs invest in real estate through the stock market.

- REIGs is investing in real estate through group ownership.

9. Tax Lien Investing

Tax lien investing is a bit more advanced than rentals or house hacking and is best for investors who already understand real estate and want to diversify into more niche opportunities.

So, the way it works is, when a property owner fails to pay their property taxes, the local government places a lien on the property. To recover the unpaid taxes quickly, the government auctions off that lien to investors. If you buy it, you’re essentially paying the taxes on behalf of the owner.

In return, the property owner must pay you back the taxes plus interest, which is sometimes at rates much higher than other investments. If they fail to pay within a set time, you may even get the right to foreclose on the property and take ownership.

This strategy has great potential for high returns and, in rare cases, acquiring property at a steep discount. However, tax lien investing requires research into property values, local laws, and owner situations. Not every lien leads to a payoff, and it can tie up your money for months or years.

Final Thoughts

Investing in real estate as a beginner doesn’t have to be overwhelming. You don’t need millions, you don’t need to be a contractor, and you don’t need perfect timing. What you do need is the willingness to start small and learn along the way.

Take the first step, whether that’s saving for a down payment, researching your local market, or testing the waters with a REIT. The sooner you get started, the sooner real estate begins working for you.

FAQ on Investing in Real Estate for Beginners

Is real estate a good investment in 2025?

Yes, real estate remains a great investment option in 2025. Housing demand continues to outpace supply in many markets, rents are rising, and property remains a proven inflation hedge. Just remember, “good investment” depends on your strategy and the location.

What is the safest way to start investing in real estate?

House hacking and REITs are usually the safest entry points. House hacking reduces your living expenses while building equity. REITs, on the other hand, are passive and don’t require hands-on management.

Can I invest in real estate with no money?

You can. Wholesaling, partnerships, or seller financing allow you to get started with little or no cash. That said, having at least some savings for emergencies makes the journey far less stressful.

What is the average ROI on rental properties?

It varies by location, but a typical range is 5–10% annually when done right. That includes both rental cash flow and property appreciation.

How much money do you need to invest in real estate?

How much money you need really depends on the strategy you choose. Some approaches have very low entry points, while others require a significant investment.

The cheapest options include real estate crowdfunding, where you can invest with a minimum of $500, or REITs, which often require $1,000–$25,000.

REIGs typically need $5,000–$50,000 to get started. If you want to invest traditionally in rental properties, you may need $100,000 or more, depending on the market and property type.